Table of contents

What is the future of payments in the hospitality space? Financial technology (or ‘FinTech’ to the initiated..) is making a dent across myriad industries so it was always unlikely that hoteliers would be spared from its disruptive influence. Transformative changes are already upon us but who is really benefiting? From the guest experience to productivity savings to fraud and cyber security, is there even any need for a change?

In fact, Mews exists precisely because of the changes in the payment landscape that are already in motion. Richard Valtr founded Mews on the back of his experiences project managing the launch of the Emblem Hotel in Prague and, back then, he realised there was a snag. “The problem that I was basically trying to solve is how to make sure everyone who comes in doesn't have to have that boring conversation at reception that roughly goes ‘Give me your credit card, give me your personal details',” he recalls. “The reason why we actually started building a PMS in the first place was because we found that, with the existing providers, we couldn't solve that problem and the main bottleneck was payments.”

Iain McDougall from Stripe, the Silicon Valley based online payments platform transforming the financial landscape, echoes Richard and is adamant the Uber experience of just-walk-out payments will affect hospitality: “Invisible payments are the future - where you only ask your client or your customer once for their payment credentials - irrespective of the channel they come through, be it online for the booking, or at checkout in the hotel or the property. It’s about making sure the payments are not intrusive for them. So I think we at Stripe have taken a lot of cues from what's gone on in the pure online world and are starting to see it now translate more to the offline world.

If companies, and the underlying payment technology that supports them, must be truly global because their consumers are global, then not only does the technology need to operate on a global basis but it also needs to somehow be very localised at the same time. It needs to be the right payment method, the right currency, via the right channel for whatever the quirks or nuances of a consumer in a certain country might be.

So we're very excited about everything that's going on in terms of how API based technologies are allowing merchants, platforms, properties or retailers to not be concerned about the complexity of how you bring all of those payment methods and instruments to market by virtue of the fact that you can now offer whatever the consumer needs. Or, rather, how to take friction out of the payment process."

Edward Hallet from growing Swedish POS startup iZettle also believes in a future with invisible payments: “Payment, ultimately, is something that you want to be invisible. You want it to be invisible as a consumer, and you really want it to be invisible as a merchant so that it doesn't get in the way of the consumer's efforts to pay. The Uber example is great because it shows you how key of a decision maker driver payments are. There's the convenience of Uber and the speed to get an Uber taxi but, actually, how much does that compare with a black cab in London? Often you can get a black cab faster. Nonetheless, the fact that you don't have to use cash drives decision making.

I think contactless payment is a very obvious case where you might find that you do business where you otherwise wouldn't because you accept a contactless form of payment. Point of sale, historically, has been based on the administrative need to manage a point of sale but also its been dictated by the friction that comes with having to have a big, fat computer on your desk to manage a transaction. With mobility, point of sale starts to shift to being where the customer wants it to be.”

Payments in Hospitality

But how does this apply to establishments in hospitality? “There’s lots of mobility in and around booking but I think that's just one part of a hotel's inventory,” Edward says. “You have all of the inventory connected with the food and beverages that you supply, for example, or you have the inventory connected with other services like massages that might take place in your establishment. There I think the digitalization of that inventory - and the fact that it sits in the cloud - can enable lots of different interactions that don't take place at your cashier desk in the front of your hotel. The obvious ones would be by using a mobile device to connect with your restaurant’s cloud point of sale to order something to my room. Or using a mobile device to order a service, like a massage, and have payment as part of that experience. There you see point of sale shifted from the checkout environment to where I want to pay as a consumer, and I think that's a trend.”

With frictionless payments consumers clearly win and it also means properties are now doing business where they otherwise wouldn't. Everyone's a winner and who isn't trying to improve the guest experience? But for properties, automating online payments brings far more benefits than just extra revenue from happier guests. Switching to online payments drastically transforms operations by driving unprecedented productivity savings as well as helping slash fraud costs.

LV, who spent years as GM of London's Good Hotel, one of the city's most unique properties, has first hand experience of the daily impact: “The single biggest frustration we had with any other system was how long it took us to do basic tasks and half of the time we had to do them manually anyways. Ever since we switched to Mews we were able to save about 10 hours a week just on admin work in the back office, which is absolutely amazing because we can suddenly concentrate on our training programme, on allocating resources and money and time into the good causes that the Good Hotel is known for.

The main difference using the Mews Merchant payment system is the fact that staff stop making mistakes, therefore they don't have to chase me or I don't have to chase them. Everything just balances, everything is there and we can see all the results, in any timezone, anywhere in the world. I miss nothing about old payment methods.”

Hoteliers are focused on the wrong things

There's clearly plenty of productivity savings that can be released by switching to automated online payments but not all hotels are as forward thinking as London's Good Hotel. The reality is that many properties are still resisting change. In short, there seem to be five misplaced points of contention amongst hoteliers:

1. General lack of awareness of the solution

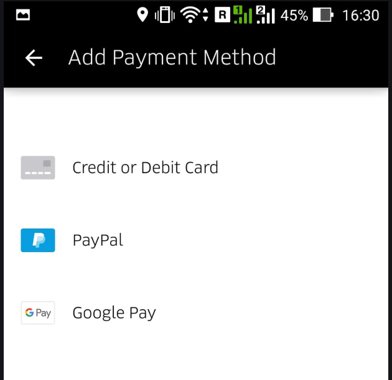

2. Concern over the lack of a personal touch by limiting payment method options for guests

3. The costs

4. The fact that old habits truly die hard

5. Worries about increased fraud.

When it comes to the personal touch, the irony is that most guests get an even more bespoke experience as a result of using online payments, as the anxiety and time it takes to process payments vanishes, while staff are focused on having real conversations with them instead. Much like we have seen with Uber, few consumers ever look back once they make the switch to invisible payments. In any case, the option to pay in other methods can still exist behind the counter.

Understandably, hoteliers want to give customers an option to either pay in cash or online, but, ultimately, it's more important to make any transaction happen quickly for guests rather than having that familiar drawn out conversation, "How would you like to pay?".

Reframe the question: “Your credit card is stored on your customer profile, would you like to pay with the card ending in 546?" and, if they agree, the conversations will take seconds as you press a button. The reality for online payments is that the moment the guest books, their credit card will be safely stored in their profile. So from the time of booking, all the way until the end, you can charge that card if they give consent. And in the case of extra charges, whether they want an extra night at the hotel or want to buy an extra towel, you can just charge the card directly and skip the payment conversation.

In any case, if at the moment the guest checks out at reception and they still want to pay in a different way, you can still give them the option to pay in cash or with a different credit card.

So it's safe to say that the idea of the personal touch is nuanced, and that automating payments empowers guests, while not actually taking away options. Meanwhile, on the perceived higher costs argument, the numbers don't stack up any more if you look at the medium and long-term. There appears to be an over-focus on the direct upfront rates, and too many overlook the productivity savings, which more than offset any higher rates.

Usually negotiations about automatic payments are overly focused on the direct rates/fees. Too often the comparison is between the rates attached to terminals versus those of the online gateway - it’s basically comparing apples with pears. Automation can bring so much more in terms of cost savings and especially productivity cost savings, beit in the back office, because all reporting is directly in their back-end system, or in other savings such as time saved at reception, and especially in the decreased need of a night auditor that is manually entering credit card numbers in the terminal.

If you see how much time it can save, both at reception and in the back office, and then multiply that by the amount of staff that you have to hire to do all those manual tasks, it really makes a difference each month. We should be showing hoteliers the bigger picture of how automation can increase productivity, rather than focus on the direct rate. But it's also about freeing up your staff to actually focus on the guests and their experience, rather than doing all those time-consuming manual tasks.

It's not just about suffering from the productivity costs of menial manual tasks, it's also about the opportunity costs the hoteliers currently have. To put it into context, Alex Handley from The Lamington Group has been rolling out their new Room2 hotel, a hybrid of an apartment, with all the perks of a hotel, and has been benefiting from online payments. “As we know, in hotels there's quite a few manual day-to-day processes for our backend teams and our reservationists,” he says. “So where we can introduce automatic processing and automatic payments in particular, it enables greater time won back in the day, or productivity improvements for those teams, and that really allows them to spend more time on the floor, talking and engaging with our guests. They can be free to deliver those genuine experiences, but it also helps us to understand our guests in a much more concise and deeper manner, so we can really look at where we can improve their experiences, and how we can work on developing the product as a whole for future markets, and for future properties as well.”

The final elephant in the room is fraud and cyber security. Not a week goes by that we don't hear of yet another data breach at a major corporation, including some of the largest hotel chains in the world. Many still believe the best answer is to seek protection in increasingly offline and manual ways of taking payments. But this is a fatal error. The real answer lies in even more advanced technologies, and by leveraging companies that are the best in class at fraud detection, such as Stripe.

“Stripe was founded with the goal to extract away the complexity of payments,” Iain McDougall reminds us. “When I think about that, and try to articulate it, I think that comes through in lots of layers. One of those is simply - how does someone who is trying to run a business and take payments from their customers get their head around all of the different pieces of financial infrastructure, and payment methods that they might have to connect to? In one layer we get rid of that entirely.

But I think security is another layer ... I think of that as a layer of complexity that, frankly, hoteliers and their customers don't want to be in the business of having to worry about, especially when it comes to payment data. I think taking away some of that inherent PCI certification, and making sure that people aren't handling raw credit card numbers and details, is essential. The technology exists such that nobody other than a payments company should be having to think about dealing with that and managing the complexity.”

Iain continues about fraud in hospitality: “It is the scourge of the payments industry and having to think about how to deal with that when it's not your core business is something that consumes a lot of resources. When you're a technology oriented company and you can leverage machine learning models that can operate at gigantic global scale, you have an advantage. For example, when any merchant processes a credit card through our system from one of their customers for the first time, there is an 86% chance that we'll have seen that exact credit card somewhere on the Stripe network somewhere in the world before, and we can make decisions based on hundreds of signals. Like when did we last see it? Where did we last see it? What did it buy? How frequently has it been used? All the way down to how long did the person that last used that credit card spend on the web page where they used it before they actually entered their card details?

All these signals are sophisticated means for identifying hacks and fraud. Ironically, we originally built some of this technology to manage that risk for ourselves first and then thought, "Hey, wouldn't this be a good idea if we turned this into a product and made it available to our customers as well?" And so that culminated in something called Radar, which is a key part of our payments platform as the data we have is allows us to do that with high fidelity.”

So it makes sense that nobody other than the payment company should be handling all of the payment risk and the ensuing complexities. Hoteliers should be focusing on their core business and not ploughing resources into trying to combat fraud when companies like Stripe can do it instead. With their advanced machine learning and global scale. Handing over loose card details should be a thing of the past. But how do these benefits actually look for a real hospitality operation?

LV recalls his time as General Manager of London’s Good Hotel again: “Security and fraud were extremely important to us and our customers. If customers can't trust us, they won't stay with us. Ever since the swap to Mews, credit card fraud cases reduced by 60%.”

Automated online payments are the future for hotels, hostels and apartments. The simple questions become, do you make the change sooner rather than later? And what solution will you choose?

Author

Mews

Essential hotel technology for general managers

Download now

Hospitality hot takes straight to your inbox

.jpg?width=624&height=555&name=GLAMPING%20(1).jpg)

.webp)